Jeremiah Shelor joined NGI in 2015 after covering business and politics for The Exponent Telegram in Clarksburg, WV. He holds a Master of Fine Arts in Literary Nonfiction from West Virginia University and a Bachelor of Arts in English from Virginia Tech.

Archive / Author

SubscribeJeremiah Shelor

Articles from Jeremiah Shelor

June Natural Gas Pulling Back as Rally Paused for Now — MidDay Market Snapshot

Having rallied sharply month-to-date, natural gas futures eased lower through midday trading Tuesday as maintenance dinged daily export demand in updated estimates. West Texas physical prices, meanwhile, were climbing out of the negatives. Here’s the latest: June Nymex futures off 3.0 cents to $2.351/MMBtu as of 2:22 p.m. ET NatGasWeather on Tuesday attributed the slide…

Natural Gas Forward Prices Rally as LNG Demand Seen Sharply Higher; Production Remains Off Highs

North American natural gas forwards rallied across the 2024 strip during the May 2-8 trading period as sagging production readings and an incrementally supportive LNG export outlook stirred bullish optimism. Benchmark Henry Hub set the tone, with June fixed prices rallying 25.5 cents week/week to reach $2.194/MMBtu, according to NGI’s Forward Look. By Monday (May…

Natural Gas Output from Appalachia, Haynesville Seen Falling Further into Early Summer

Combined natural gas production from seven key Lower 48 plays is expected to ease lower in June, with declines from gas-weighted plays continuing to offset increasing associated output from the Permian Basin, according to updated projections from the U.S. Energy Information Administration (EIA). In its latest Drilling Productivity Report (DPR), published Monday, EIA said it…

Natural Gas Futures Pare Gains Early as Maintenance Seen Impacting LNG Flows

Natural gas futures gave back some of their recent gains early Tuesday as traders weighed a fundamental outlook featuring softer export demand and continued springtime production weakness. After a double-digit rally to open the week, the June Nymex contract was off 3.6 cents to $2.345/MMBtu at around 8:40 a.m. ET. Flow data early Tuesday showed…

Brightening LNG Outlook Spurs Further Natural Gas Futures Gains — MidDay Market Snapshot

With summer cooling demand just around the corner, and with continued signs of renewed strength at a major U.S. export terminal, natural gas futures were charting another leg higher through midday trading. Here’s the latest: June Nymex futures up 12.3 cents to $2.375/MMBtu at around 2:30 p.m. ET Flows to U.S. LNG terminals surpassing 13…

Natural Gas Futures Steady as Consolidation Said Possible After May Rally

Having surged higher since the start of the month, natural gas futures were steady in early trading Monday as the market continued to weigh a mixed shoulder season fundamental outlook. The June Nymex contract was up fractionally at $2.253/MMBtu as of 8:40 a.m. ET. July was off 1.2 cents to $2.472. While the front month…

Natural Gas Forward Prices Rally as LNG Demand Seen Sharply Higher; Production Remains Off Highs

North American natural gas forwards rallied across the 2024 strip during the May 2-8 trading period as sagging production readings and an incrementally supportive LNG export outlook stirred bullish optimism. Benchmark Henry Hub set the tone, with June fixed prices rallying 25.5 cents week/week to reach $2.194/MMBtu, according to NGI’s Forward Look. Negative Basis In…

Brightening LNG Demand Outlook Helping to Lift Natural Gas Forwards; West Texas Production Constrained

North American natural gas forwards rallied across the 2024 strip during the May 2-8 trading period as sagging production readings and an incrementally supportive LNG export outlook stirred bullish optimism. Benchmark Henry Hub set the tone, with June fixed prices rallying 25.5 cents week/week to reach $2.194/MMBtu, according to NGI’s Forward Look. Negative Basis in…

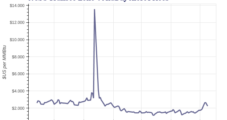

Natural Gas Futures Finding New Highs; Waha Still Getting Crushed — MidDay Market Snapshot

Natural gas futures were pushing higher at the front of the curve through midday trading Thursday after the latest government-reported inventory build landed on the leaner side of market expectations. Here’s the latest: June Nymex futures up 10.8 cents to $2.295/MMBtu as of 2:13 p.m. ET Reported 79 Bcf storage build from U.S. Energy Information…

June Natural Gas Slightly Higher as Market Turns to EIA Report

Natural gas futures tested both sides of even in early trading Thursday as the market awaited the latest government inventory report, which was expected to show an injection roughly in line with historical norms. The June Nymex contract was trading at $2.205/MMBtu at around 8:40 a.m. ET, up 1.8 cents. July was up 0.8 cents…